Pvm Accounting for Beginners

Pvm Accounting for Beginners

Blog Article

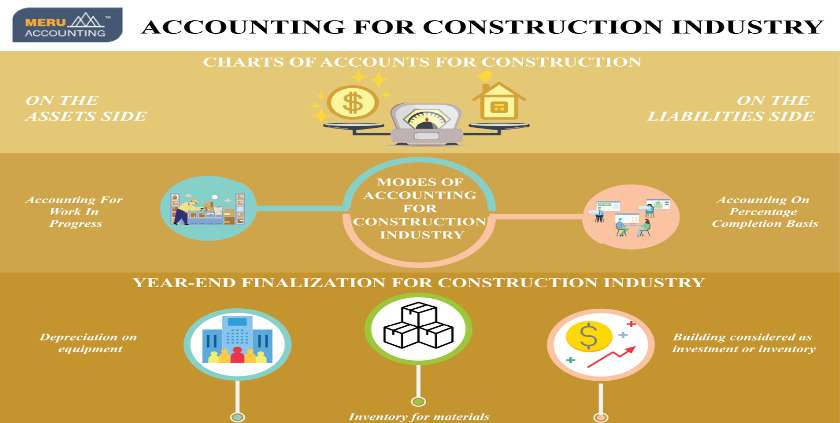

The Best Strategy To Use For Pvm Accounting

Table of ContentsPvm Accounting Things To Know Before You Get ThisThe 8-Minute Rule for Pvm Accounting6 Simple Techniques For Pvm AccountingThe 30-Second Trick For Pvm AccountingA Biased View of Pvm AccountingThe Best Strategy To Use For Pvm Accounting

Oversee and handle the development and authorization of all project-related billings to customers to cultivate great communication and avoid issues. construction accounting. Ensure that appropriate records and paperwork are submitted to and are upgraded with the IRS. Ensure that the audit process adheres to the law. Apply needed building audit criteria and procedures to the recording and reporting of building and construction activity.Understand and keep basic expense codes in the audit system. Interact with different financing firms (i.e. Title Business, Escrow Company) concerning the pay application process and needs required for settlement. Take care of lien waiver dispensation and collection - https://www.kickstarter.com/profile/pvmaccount1ng/about. Display and resolve bank concerns including charge abnormalities and check distinctions. Aid with executing and keeping inner financial controls and procedures.

The above declarations are meant to define the basic nature and level of work being performed by individuals appointed to this classification. They are not to be interpreted as an exhaustive checklist of responsibilities, responsibilities, and skills required. Workers might be needed to execute obligations outside of their typical responsibilities from time to time, as required.

Pvm Accounting Fundamentals Explained

You will aid support the Accel team to make certain distribution of successful promptly, on budget, jobs. Accel is looking for a Building and construction Accountant for the Chicago Office. The Construction Accounting professional executes a variety of accounting, insurance coverage compliance, and project administration. Functions both separately and within particular divisions to maintain monetary records and ensure that all documents are kept present.

Principal responsibilities include, yet are not limited to, taking care of all accounting functions of the firm in a prompt and precise manner and supplying reports and routines to the business's CPA Company in the preparation of all economic statements. Makes sure that all bookkeeping treatments and functions are taken care of accurately. In charge of all monetary documents, payroll, financial and daily procedure of the audit function.

Works with Job Managers to prepare and post all regular monthly invoices. Produces regular monthly Job Cost to Date reports and functioning with PMs to reconcile with Project Supervisors' budgets for each task.

The Ultimate Guide To Pvm Accounting

Efficiency in Sage 300 Building And Construction and Realty (previously Sage Timberline Workplace) and Procore construction management software an and also. https://www.edocr.com/v/0bwa8kov/leonelcenteno/pvm-accounting. Have to likewise be competent in various other computer software program systems for the prep work of records, spreadsheets and various other accountancy evaluation that may be required by monitoring. Clean-up bookkeeping. Must possess solid business skills and capacity to prioritize

They are the monetary custodians that ensure that building projects stay on budget plan, abide by tax policies, and maintain financial openness. Building and construction accountants are not just number crunchers; they are strategic partners in the building procedure. Their key role is to take care of the economic aspects of building jobs, guaranteeing that resources are designated efficiently and economic threats are lessened.

Fascination About Pvm Accounting

They work very closely with job managers to develop and monitor spending plans, track expenses, and projection financial demands. By keeping a tight hold on project finances, accounting professionals aid prevent overspending and monetary setbacks. Budgeting is a cornerstone of effective building and construction projects, and building accountants contribute in this respect. They develop detailed spending plans that incorporate all project expenses, from products and labor to permits and insurance.

Construction accountants are fluent in these guidelines and make certain that the project complies with all tax obligation demands. To excel in the duty of a building accountant, individuals require a solid educational foundation in audit and money.

Additionally, qualifications such as Cpa (CPA) or Certified Construction Market Financial Professional (CCIFP) are highly related to in the sector. Working as an accountant in the building and construction market comes with a distinct set of challenges. Building and construction projects frequently involve tight target dates, transforming regulations, and unexpected expenditures. Accounting professionals need to adapt promptly to these difficulties to keep the job's economic wellness intact.

What Does Pvm Accounting Mean?

Professional certifications like CPA or CCIFP are also highly suggested to show knowledge in construction accounting. Ans: Construction accountants produce and monitor spending plans, identifying cost-saving chances and making certain that the task stays within budget plan. They additionally track expenses and forecast financial requirements to stop overspending. Ans: Yes, construction accounting professionals manage tax obligation compliance for building and construction tasks.

Intro to Construction Audit By Brittney Abell and Daniel Gray Last Updated Mar 22, 2024 Building firms need to make difficult options amongst many economic choices, like bidding process on one job over an additional, choosing financing for materials or equipment, or establishing a job's profit margin. On top of that, construction is an infamously unpredictable market with a high failure rate, slow-moving time to settlement, and irregular capital.

Normal manufacturerConstruction service Process-based. Production includes repeated procedures with conveniently identifiable costs. Project-based. Manufacturing requires various procedures, products, and devices with varying expenses. Repaired area. Manufacturing or production happens in a single (or numerous) controlled places. Decentralized. Each task takes location in a new area with varying site conditions and unique challenges.

The Facts About Pvm Accounting Uncovered

Long-lasting relationships with vendors ease settlements and improve performance. Irregular. Regular use different specialized contractors and suppliers influences performance and capital. No retainage. Payment gets here in complete or with normal payments for the complete contract amount. Retainage. Some section click this site of settlement might be kept till task conclusion even when the contractor's job is completed.

Routine production and temporary contracts result in workable cash money flow cycles. Irregular. Retainage, slow repayments, and high ahead of time prices cause long, uneven cash flow cycles - construction bookkeeping. While standard manufacturers have the advantage of controlled atmospheres and enhanced manufacturing processes, building and construction firms must constantly adapt to each new job. Even somewhat repeatable tasks call for adjustments because of site problems and various other variables.

Report this page